Table of Contents:

1. Introduction

2. FDI Trends and Statistics in Nepal

3. The Importance of Finance for Economic Development

a. Financial System Efficiency and Growth

b. Gaps in Financial Inclusion

4. Promoting Financial Inclusion

5. Conclusion

Foreign Direct Investment;

Finance, and Economic Development: Catalysts for Growth

Foreign Direct Investment (FDI) plays a pivotal role in the global economy, significantly influencing the financial landscapes and economic development of host countries. By definition, FDI involves an investment made by a firm or individual in one country into business interests located in another country. This investment can take various forms, including establishing new operations, acquiring existing businesses, or forming joint ventures.

Economic development is a multifaceted process, driven by various factors that collectively contribute to sustained progress and improved living standards. Among these drivers, foreign direct investment (FDI) and access to finance stand out as critical catalysts, fueling growth, innovation, and entrepreneurship across nations.

FDI involves the investment of foreign capital by an entity or individual in a business operation within another country, often accompanied by the acquisition of a significant management interest.

FDI Trends and Statistics in Nepal

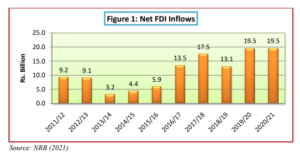

1.1 Gross FDI inflows increased by 1.2 percent to Rs.19.9 billion in 2020/21. The divestment of foreign investment (repatriation of investment) during 2020/21 remained at Rs.396.7 million which is around 2.0 percent of gross FDI inflows (NRB, 2022).

1.2 Net FDI inflows to Nepal increased by 0.2 percent to Rs.19.5 billion in 2020/21.

1.3 The recent trend of FDI realization shows that there is a huge gap between approved FDI and actual net FDI inflows in Nepal.

1.4 The FDI approval may indicate an intended investment (the approved investment may not actually take place) or there may be significant time lags between approvals and actual investments. In some instances, the realization of the approved investment may take place over several years as usually seen in projects with longer gestation period. Hence, there is a gap between FDI approval and actual FDI inflows.

The Importance of Finance for Economic Development:

Access to finance is a crucial enabler for economic development, facilitating investment, innovation, and entrepreneurship. Well-functioning financial systems can mobilize domestic savings, allocate capital efficiently, and mitigate risks, supporting sustainable economic growth.

a. Financial System Efficiency and Growth: According to the World Bank’s Global Financial Development Report 2022, countries with deeper and more efficient financial systems tend to experience faster economic growth and higher levels of productivity.

b. Gaps in Financial Inclusion: However, significant gaps in financial inclusion persist, particularly in developing economies, where a substantial portion of the population remains unbanked or underserved by formal financial institutions.

Promoting Financial Inclusion:

Initiatives aimed at promoting financial inclusion can contribute to economic development by providing individuals and businesses with access to essential financial services, such as credit, savings, and insurance. Fintech innovations, including mobile banking and digital payments, have the potential to bridge the financial inclusion gap by leveraging technology to reach underserved populations.

Governments, international organizations, and the private sector play crucial roles in fostering an enabling environment for financial inclusion through supportive policies, regulatory frameworks, and investment in infrastructure.

Foreign direct investment and well-functioning financial systems are vital catalysts for economic development, particularly in developing and emerging economies. By attracting FDI and promoting financial inclusion, countries can unlock opportunities for job creation, productivity gains, and sustainable economic growth. Collaborative efforts among policymakers, businesses, and international institutions are essential to create an environment conducive to investment, technology transfer, and access to finance, thereby unlocking the full potential of these powerful drivers of economic progress.