CKYC in Nepal: Enhancing Financial Security and Efficiency

Central KYC (CKYC) is a critical initiative aimed at streamlining and securing the process of Know Your Customer (KYC) in the financial sector. In Nepal, CKYC has been gaining momentum as a means to improve financial transparency, reduce fraud, and enhance customer experience. This article explores the concept of CKYC, its implementation process, and its significance in Nepal’s financial landscape.

What is CKYC?

CKYC stands for Central Know Your Customer. It is a centralized repository of KYC records of customers in the financial sector. Managed by a central authority, CKYC aims to consolidate KYC information to make it accessible to various financial institutions, ensuring uniformity and reducing redundancy. In Nepal, this system is overseen by the Nepal Rastra Bank (NRB), the central bank of Nepal.

The CKYC Process in Nepal

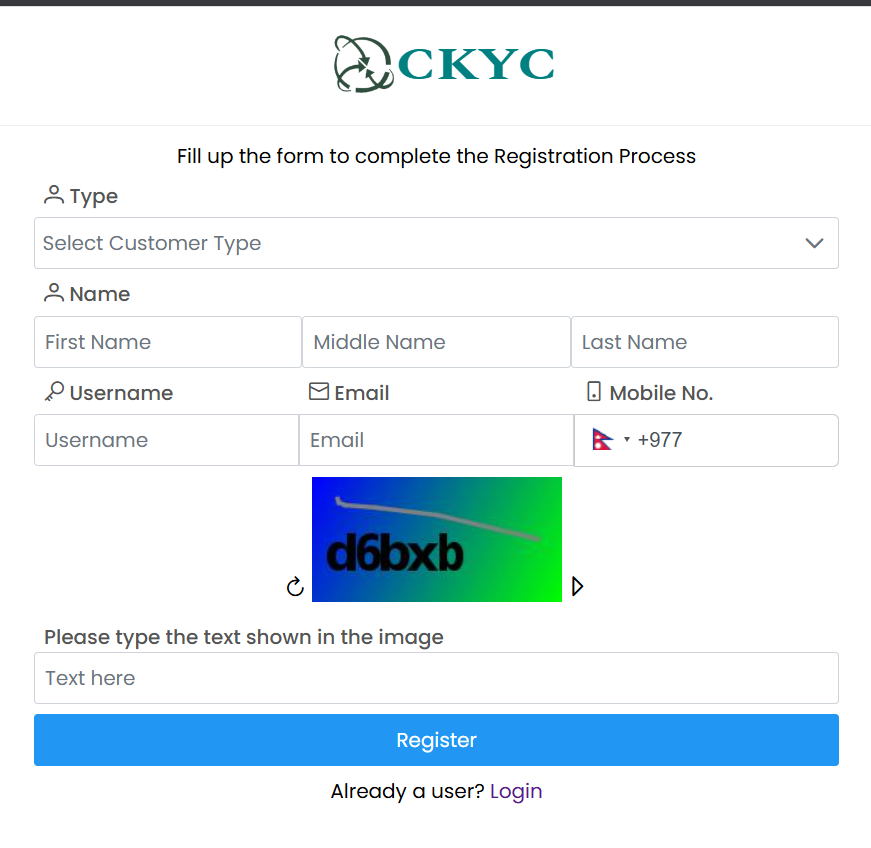

1. Customer Onboarding:

– When a customer opens an account with a financial institution (such as banks, insurance companies, or mutual funds), they are required to submit their KYC documents.

– These documents typically include proof of identity (such as a citizenship certificate or passport), proof of address, and a recent photograph.

2. Data Submission:

– The financial institution collects and verifies these documents.

– Once verified, the KYC data is digitized and uploaded to the central CKYC repository managed by the NRB.

3. Unique Identification:

– Each customer is assigned a unique CKYC identifier.

– This identifier is used by all financial institutions to retrieve the customer’s KYC information from the central repository.

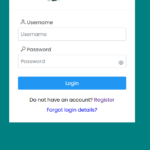

4. Data Retrieval:

– Financial institutions can access the CKYC repository to retrieve KYC information when a customer seeks to open a new account or perform transactions that require KYC verification.

– This process eliminates the need for customers to submit their KYC documents multiple times, simplifying their experience.

Benefits of CKYC

1. Efficiency:

– CKYC streamlines the KYC process by centralizing data, reducing redundancy, and saving time for both customers and financial institutions.

2. Security:

– A centralized system minimizes the risk of fraud by ensuring that KYC data is consistent and verified.

– It enhances the security of customer information by reducing the chances of identity theft and document falsification.

3. Convenience:

– Customers no longer need to submit their KYC documents multiple times across different financial institutions.

– This ease of use improves customer satisfaction and encourages more people to engage with formal financial services.

4. Regulatory Compliance:

– CKYC helps financial institutions comply with regulatory requirements by maintaining a standard process for KYC verification.

– It supports the NRB’s efforts to monitor and regulate the financial sector more effectively.

Applications of CKYC

1. Banking:

– CKYC is widely used in the banking sector for opening savings accounts, fixed deposits, and applying for loans.

– It facilitates quick and secure customer verification, enabling smoother banking operations.

2. Insurance:

– Insurance companies use CKYC to verify the identity of policyholders, ensuring compliance with regulatory norms and reducing fraud.

3. Investment:

– Mutual funds and other investment firms rely on CKYC to streamline the process of onboarding investors and verifying their credentials.

The implementation of CKYC in Nepal marks a significant step towards enhancing financial security, efficiency, and customer convenience. By centralizing KYC data, the system not only reduces redundancy but also strengthens the integrity of the financial sector. As more institutions adopt CKYC, it is expected to play a crucial role in fostering a transparent, secure, and customer-friendly financial environment in Nepal.