What is CKYC in Nepal?

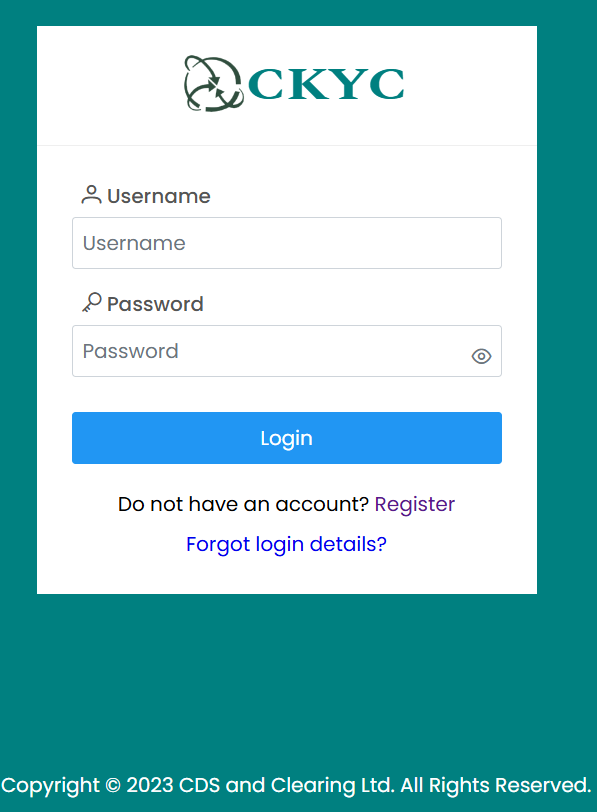

The Central Know Your Customer (CKYC) is a central repository of KYC records for customers in Nepal, maintained by the CDS and Clearing Ltd. CKYC aims to streamline the KYC process by ensuring that customers complete the process only once and their data is accessible to all financial institutions, thereby avoiding repetitive documentation.

Implementation and Mandate:

The Nepal Rastra Bank (NRB) announced the implementation of CKYC as part of its updated KYC and Anti-Money Laundering (AML) standards on February 27, 2012. It is a mandatory requirement for all banks and financial institutions to adhere to CKYC standards, following the guidelines set forth by the Asset (Money) Laundering Prevention Act, 2008, and the accompanying rules of 2009.

Process of CKYC:

To complete CKYC, customers need to provide personal details such as their full name, date of birth, address, and identification documents (e.g., citizenship certificate, passport, driver’s license). The process involves filling out a CKYC form, either online or through physical submission at the respective financial institution. Once the information is submitted, it gets verified and stored digitally in the CKYC registry, making it accessible for future reference by all financial entities.

Usage and Benefits:

CKYC significantly benefits both customers and financial institutions. Customers do not need to repeat the KYC process for every new financial service they wish to avail themselves of, as their information is already available in the centralized registry. This saves time and effort for both parties. Financial institutions can access this data to verify customer identity, ensuring compliance with regulatory standards without the need to repeatedly collect the same information.

Where CKYC is Used:

CKYC data is used by various financial institutions, including banks, insurance companies, mutual fund companies, and other entities regulated by NRB. It plays a crucial role in preventing financial fraud, money laundering, and other illegal activities by ensuring that only verified individuals can open and operate accounts.

CKYC is an essential component of Nepal’s financial infrastructure, enhancing the efficiency and security of financial transactions. By centralizing customer data and making it easily accessible to authorized institutions, CKYC helps streamline processes and reduce the risk of fraud.