Table of Contents:

- What is CKYC in Nepal?

- Why is CKYC Important?

- Steps to Obtain CKYC

- Step 1: Visit an Authorized Bank or Broker

- Step 2: Required Documents for CKYC

- Step 3: Document Verification Process

- Step 4: CKYC Number Issuance

- Benefits of CKYC

- FAQs on CKYC in Nepal

1. What is CKYC in Nepal?

CKYC (Centralized Know Your Customer) is a national initiative to simplify customer identity verification across financial institutions in Nepal.

2. Why is CKYC Important?

It streamlines the KYC process, allowing you to use one verified identity across multiple banks and brokers.

3. Steps to Obtain CKYC:

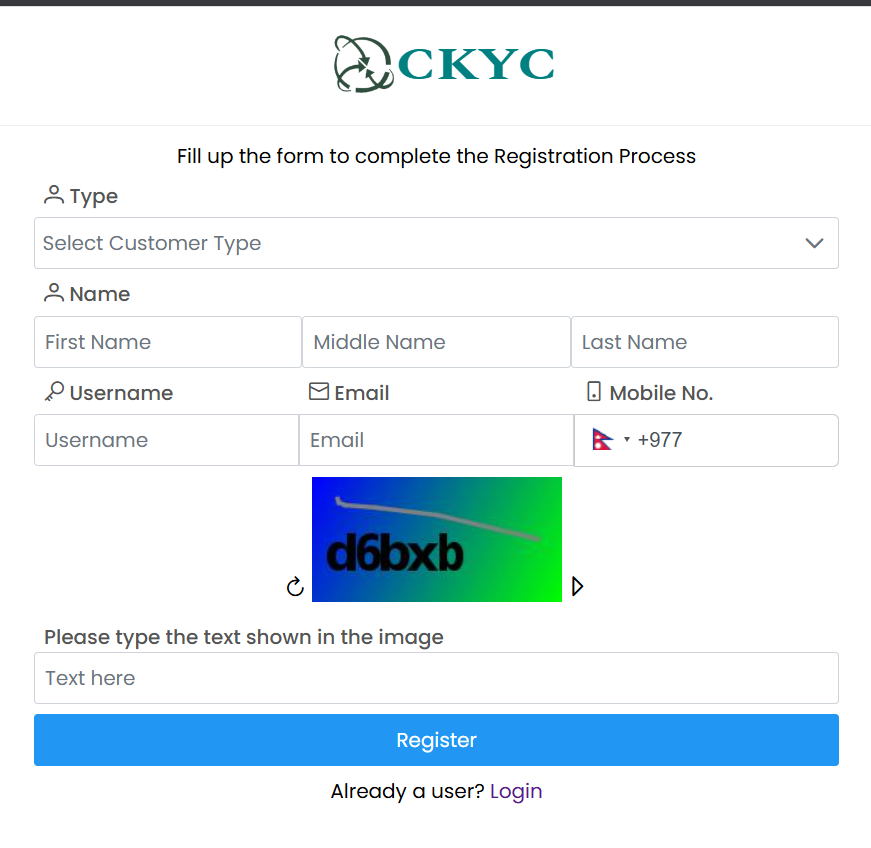

- Step 1: Visit a bank or broker authorized by the Central Depository System (CDSC) for CKYC registration.

- Step 2: Submit identification documents like your citizenship, passport, or voter ID, along with address proof and a photograph.

- Step 3: Your documents will be verified by CDSC.

- Step 4: Once approved, you will receive a unique CKYC number.

4. Benefits of CKYC:

- Hassle-free financial transactions.

- Simplifies the identity verification process for investments, accounts, and other financial services.

For more details, visit CDSC’s CKYC page.