PAN Card in Nepal: A Comprehensive Guide

A Permanent Account Number (PAN) card is an essential document for individuals and businesses in Nepal. It serves as a unique identifier for tax purposes, streamlining financial transactions and ensuring transparency in the economy. In this article, we will explore the significance of the PAN card in Nepal, its application process, the benefits it offers, and the recent digitalization efforts aimed at making the process more accessible.

What is a PAN Card?

A PAN card is a unique alphanumeric identifier issued by the Inland Revenue Department (IRD) of Nepal. It is mandatory for taxpayers, including individuals, businesses, and organizations, to obtain a PAN card for various financial and tax-related activities. The PAN card ensures that all financial transactions are recorded and tracked by the tax authorities, reducing the possibility of tax evasion and fostering a more transparent economic environment.

Importance of PAN Card in Nepal

The introduction of the PAN card system in Nepal is a significant step toward modernizing the country’s tax infrastructure. The PAN card is not just a tax-related document; it has several broader implications:

1. Tax Compliance: The PAN card is mandatory for filing income tax returns in Nepal. It serves as a proof of identity for taxpayers, ensuring that all income and expenses are accurately reported to the tax authorities.

2. Financial Transactions: The PAN card is required for various financial transactions, including opening a bank account, applying for loans, and making significant investments. It acts as a safeguard against money laundering and ensures that all large financial transactions are monitored.

3. Business Registration: For businesses, having a PAN card is crucial for registering with the government and conducting business legally. It is also required for participating in government tenders and contracts.

4. Salary Verification: Employers in Nepal are required to deduct taxes from their employees’ salaries and deposit them with the government. A PAN card ensures that the correct amount of tax is deducted and helps in salary verification during audits.

How to Apply for a PAN Card in Nepal

The process of obtaining a PAN card in Nepal has been simplified and digitalized, making it easier for individuals and businesses to apply. Here is a step-by-step guide to applying for a PAN card:

1. Visit the IRD Website: The first step in applying for a PAN card is to visit the official website of the Inland Revenue Department of Nepal. The website provides all the necessary information and forms required for the application process.

2. Fill Out the Application Form: The PAN application form, known as Form No. 2, is available for download on the IRD website. Applicants need to fill out the form with accurate personal and financial details. The form requires information such as the applicant’s name, address, date of birth, citizenship number, and contact information.

3. Submit Required Documents: Along with the application form, applicants must submit copies of their citizenship certificate, passport-sized photographs, and proof of address. For businesses, additional documents such as the company registration certificate and board resolution are required.

4. Submit the Application: Once the form is filled out and the necessary documents are attached, the application can be submitted either online or in person at the nearest tax office. The online submission process has been introduced to make the application process more convenient and to reduce paperwork.

5. Receive the PAN Card: After the application is processed and approved by the IRD, the PAN card will be issued to the applicant. The card is usually delivered within a few weeks, depending on the mode of application.

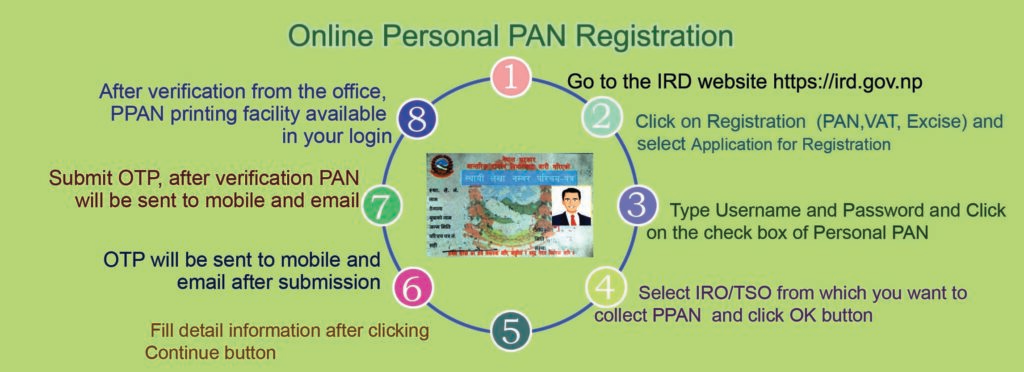

Digitalization of PAN Card Services

In recent years, the Government of Nepal has taken significant steps to digitalize the PAN card application process. The introduction of the online PAN registration system has made it easier for individuals and businesses to apply for a PAN card without having to visit the tax office physically. The online system allows applicants to fill out the application form, upload the required documents, and submit the application electronically.

The digitalization of PAN card services is part of a broader effort by the government to promote e-governance and improve the efficiency of public services. The online PAN registration system reduces the time and effort required to obtain a PAN card, making it more accessible to people in remote areas.

Benefits of Having a PAN Card in Nepal

The PAN card offers several benefits to individuals and businesses in Nepal:

1. Transparency in Financial Transactions: The PAN card helps in maintaining transparency in financial transactions by ensuring that all income and expenses are recorded. This reduces the chances of tax evasion and promotes a fairer tax system.

2. Simplified Tax Filing: With a PAN card, filing income tax returns becomes more straightforward. The PAN number is used to track all tax-related activities, making it easier for taxpayers to comply with tax laws.

3. Access to Financial Services: A PAN card is required to access various financial services, such as opening a bank account, applying for loans, and investing in securities. It acts as a proof of identity for financial transactions.

4. Eligibility for Government Schemes: Many government schemes and subsidies are linked to the PAN card. Having a PAN card ensures that individuals and businesses can take advantage of these schemes and receive benefits.

5. Avoidance of Penalties: Failure to obtain a PAN card or provide the PAN number during financial transactions can result in penalties. Having a PAN card ensures compliance with tax laws and avoids legal complications.

Challenges and Future Prospects

While the introduction of the PAN card system in Nepal has brought numerous benefits, there are still challenges that need to be addressed. One of the significant challenges is the lack of awareness among the general public about the importance of obtaining a PAN card. Many people, especially in rural areas, are still unaware of the benefits and requirements of the PAN card.

To address this issue, the government needs to conduct awareness campaigns and provide information on the importance of the PAN card. Additionally, efforts should be made to simplify the application process further, especially for those who may not have access to the internet or are not familiar with digital platforms.

In the future, the government may consider linking the PAN card with other identification systems, such as the National Identity Card, to create a unified identification system. This would further streamline financial transactions and improve the efficiency of public services.

The PAN card is a vital document for individuals and businesses in Nepal. It plays a crucial role in ensuring tax compliance, promoting transparency in financial transactions, and providing access to various financial services. With the digitalization of the PAN card application process, the government has made it easier for people to obtain a PAN card and enjoy its benefits. However, there is still a need for increased awareness and further simplification of the process to ensure that everyone in Nepal can take advantage of this essential service.

As Nepal continues to modernize its tax infrastructure, the PAN card will remain a cornerstone of the country’s efforts to promote economic transparency and efficiency. By obtaining a PAN card, individuals and businesses can contribute to the development of a fairer and more robust tax system in Nepal.

Pingback: How to Set Up a Contract Office in Nepal: A Complete Guide for International Businesses - veshraj.com How to Set Up a Contract Office in Nepal